Extra Buzz 006: Masks First, then Livestreaming For All

Dear Extra Buzzers,

Announcement: If you’re looking for more China insider knowledge & analysis, we are working on it, and one of those is a new webinar product for institutional and professional investors.

As a paid member of Extra Buzz, you are invited to our pilot session! Our first is on luxury retail in China set for Monday, April 6, 2020, 5-6PM PST / 8-9PM (April 7 8AM-9AM China time). Our guest is the Asia Pacific head of a well-known boutique luxury brand. If you want to get a firsthand account of how the virus has impacted the industry and one expert’s ideas on where it’s going, look no further. The session will be interactive and have limited capacity, so please sign up here. Capacity is limited, so sign up soon!

As always, we have one ask – we are looking for more ratings & reviews of Tech Buzz the podcast on iTunes, which is still a big discovery engine for us. If you have some time and are an iPhone user, please give us a rating or review here.

Also, as you might have seen before, we recently became subscribers of the China Esports Business News Digest and think some of you might be interested too. Here’s a bit more about it:

The China Esports Business News Digest is a weekly, executive summary style email newsletter with links to sources in English and Chinese. China’s esports market has been the largest by consumers for a while, but now is also the largest by aggregate revenue, recently surpassing North America. This newsletter is designed as a guide for experts and newcomers alike, so if you are interested in this area, click here to sign up.

Stay well!

Rui & Ying-Ying

Chinese Manufacturing: Make Masks First, Then Make Other Stuff

The whole world needs masks to fight the highly contagious COVID19. As you might have seen, even US and European car companies are pledging their support, such as Fiat, who has converted some capacity in its China plant to make one million masks a month. But let’s see how that compares to what fellow automaker BYD has done. BYD, the electric vehicle maker 25% owned by Berkshire Hathaway, has been repurposing its manufacturing lines to make masks since the beginning of February. Other car manufacturers, numerous smartphone makers, diaper makers, and large-scale manufacturers such as Foxconn have jumped in the fray as well, most, it seems, as early as February 6, the first day work was allowed to resume, and one week after what would have been the original end of the weeklong Chinese New Year’s holidays. However, this supply was not available on the free market, even though rumors ran rampant on WeChat of folks trying to take advantage of the opportunity and scam mass group purchases. Inventory was designated first for frontline health workers as requested by the government, then company employees, followed by supply chain partners. BYD, one of the companies who’s been able to leverage this into a successful PR campaign, not least because it’s now the largest mask manufacturer in the world at 5 million per day, has acknowledged that this move was necessary to save its own business, which employs over 200,000 factory workers. If its own factories and those of upstream suppliers cannot open due to inadequate protective gear, the most immediate victim would have been itself.

BYD auto owners were also given masks for each 600 points they accumulated on BYD’s e-commerce platform.

What I found most interesting about all this news, however, is the speed at which BYD can repurpose its manufacturing lines. Plans would be drawn up and finished in 3 days, equipment manufactured in 7, and the first batch of products ready in 10. In addition to surgical masks, they’ve since also ramped up production of N95 masks, and antibacterial disinfectant (50,000 bottles per day). Almost everything has been done in-house, including making 90% of the 1000 components that were needed to build the new mask-making machines. The exception, of course, being the raw materials, which had to be procured. For BYD, who presumably has a large government relations team and was also providing a critical service, the government stepped in to assist, because the fabric for surgical masks had gone up by up to 25x due to the hike in demand. To manage the production, BYD assigned the best and brightest to these new initiatives. Then, as is common within Chinese internet companies, an internal competition was held to discover best practices. A daily cash bonus went to the team that topped the internal leaderboard for production, with the record broken at over 50,000 a day. All in all, some 130 factory lines have been repurposed for mask-making, which explains the 5mm a day number.

As a point of reference, prior to the epidemic, China’s over-600 factories engaged in mask-making was only making 20mm a day, and only 54% of those are fit for surgical use, which means roughly 10mm a day, half of the global output for surgical masks, was the norm pre-COVID19. Now, BYD alone is shouldering roughly 25% of the world’s prior output, just 50 days after the initial Wuhan lockdown. China’s entire output has now increased by 12x, with over 3,000 manufacturers joining in, and it shows no sign of slowing down. It’s a pragmatic move, especially with the pandemic having now reached 199 countries, and orders cancelled en masse by overseas buyers who’re suddenly seeing a precipitous drop in demand. Making PPE (personal protective equipment) items seem like the best bet, if you have the ability to switch over, that is. For those who can, even luxury fashion houses like Louis Vuitton have pledged to help. Great CSR opportunity while self-helping – as we’ve seen, the big manufacturers were as much motivated by contributing to society as they were by keeping themselves afloat by securing the entire supply chain. Remember, not only are masks a great and responsible idea, but as we discussed in Extra Buzz #4, were often mandated to restart operations. You literally couldn’t operate until your workers were donned in the proper PPE. Unfortunately for the world, ventilators are not quite so easy to make, and are not necessary for saving one’s own production line. Let’s hope more Chinese manufacturers join in anyway, if only for the economic benefits. It looks like we need it.

Livestreaming Ecommerce (Might) Save the Day, Whether You Have Sales or Not

We’re in the middle of a telehealth deep dive on Tech Buzz, so it wouldn’t be for another few weeks before we get to return to the topic that’s been the biggest headline in China tech for the past year, livestreaming ecommerce. So consider this a brief preview of more to come. Thanks to COVID19, this is a business model that’s accelerated even more over the past few weeks, which is impressive, given how much mindshare it already had. Of course, my favorite reference is always our very own Tech Buzz Episode 54 for those looking for more background, but the concept doesn’t really need any more explanation. Livestream and sell. But in China, because of continued travel restrictions and social distancing, some industries – real estate and travel, for example – are using it to build pipeline (种草 in Chinese) in this wait-and-see period while others are doubling down, such as fashion and short video.

Backtracking a few weeks, as early as the week of 2/17, which was just 4 weeks after the initial lockdown in Wuhan, Alibaba’s Taobao Livestreaming had been rapidly ramping up the onboarding of “traditionally offline” businesses including 4000 factories, 500 properties (typically apartment complexes, not individual houses), 400 car dealerships, and 5000 real estate brokers. Property sales, in particular, have been encouraging. While it’s being touted as “VR + cloud shopping,” really it’s just interactive 360-degree photos that allow for a virtual walkthrough of the property in question. Such services have been in existence since at least 2018, but Evergrande was the first to do promotions around it during the epidemic, as early as 2/13. If you think that it would be very difficult to make a decision on purchasing a property based on some photos alone, you’d be correct. In two examples with well-known developers, we see that over 4 hours of livestreaming resulted in just one finalized transaction, and for another, near ten thousand viewers turned in for 3 sales. For some 88 major cities in China, sales volumes during Chinese New Year’s declined 63% versus the same period in 2018.

A 360-degree “VR” walkthrough of an apartment for sale.

However, despite the low transaction volume, everyone is eager to continue livestreaming. Probably at least in part because there’s not much else they can do, but also because this allows them to build up a warm pipeline for when the market does finally recover. In addition, there are real advantages to cloud house-shopping. Not only can you accommodate massive numbers of potential buyers at a time – no need for tedious appointment making and congested homes – but since in China many home-purchasing decisions tend to be a family affair, this was an easy way of getting everyone together, such as out-of-town parents, and streamline decision making. Narrow the inventory online first before making the final call after the in-person visit. Potentially, the entire house-buying process changes to be more of a hybrid online-offline process than it already is. But if not, then at the very least, livestreaming will help to accelerate the recovery.

It’s much the same in the homestay sector, which can cover anything from individual units in apartment buildings that landlords are renting out Airbnb-style, or actual boutique bed-and-breakfasts with multiple rooms. Demand is down 80-90% (data aggregated from property management systems). It’s especially debilitating for some popular tourist hotspots in warmer locales that typically get 15-30% of their whole-year’s revenues from the winter season through Chinese New Year’s. For some of these folks, we are talking about a 30-50% hit for the year, and I think that’s being optimistic. Luckily, cashflows aren’t as bad as SMBs overall though, of whom past surveys have revealed over two-thirds to be at two months or less runway. For homestays, just 10% have only 2 months or less of runway, and 50% are confident they’ve got at least half a year’s worth. But business is so bad that some have refrained from re-opening altogether, what with the many certifications that owners need to go through to resume operations, and the still fairly onerous restrictions even on domestic travel.

A homestay owner livestreaming their property.

Instead, like the real estate agents, they are turning to livestreaming to build future customer pipeline. Some platforms do allow for easy e-commerce during the livestream, so operators are experimenting with presales for the summer and even the fall, just so they can get enough cashflow for the next few months. However, for the most part, many homestays are just trying to put out content and gather fans. Yet others have begun to sell other items through their livestream, such as local foods, while they wait for tourism to pick up. It just goes to show, wherever there is some semblance of trust and credibility, there is an opportunity to sell something.

As for fashion, one of livestreaming’s best friends, we’ve already talked about retailers use livestreaming, but now even wholesalers are getting into it. Guangzhou, which always been a main hub of clothing manufacturing, has put out a municipal plan encouraging all sorts of innovation for the industry, with livestreaming ecommerce as a major priority. In typical Chinese government fashion, where input is measured over output, they have announced a series of top-down goals. These may not be commercially successful, but will for sure spur related investment anyway. That is how it always works in China. Anyway, the goals include incubating and promoting 100 MCNs, 1000 internet brands, 10,000 livestreamers, etc. And it’s not just Guangzhou, of course. The number of stores opening up livestreaming functionality on Taobao has similarly increased by leaps and bounds, up more than 7x in February versus the month before. The epidemic made livestreaming an obvious choice but Alibaba further ushered in the craze by removing all service fees, and nothing grows a business more than “free.” The most obvious winning categories are apparel, cosmetics, food and jewelry – basically all the things that are visually enticing in video format and could be marketed in an entertaining way, and questions easily answered, advantages easily highlighted.

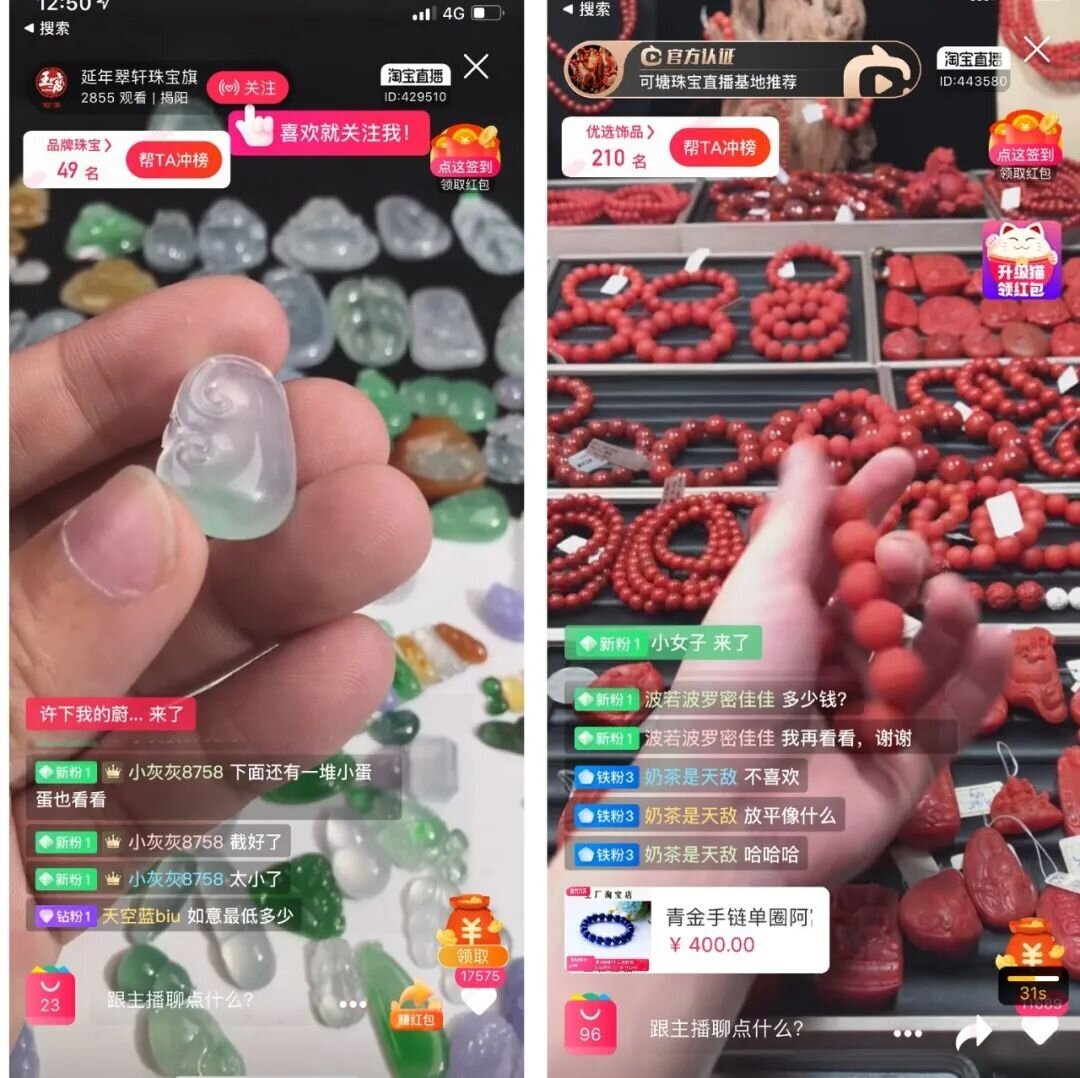

Taobao livestreaming of jewelry.

They’ve also provided support and training to livestreamers for the more famous malls, which we noted in Extra Buzz 004 as a problem that many shops faced – the lack of trained livestreamers, which is, after all, still different from selling offline. As evidence of this demand, a leading recruitment platform noted that livestreamer recruitment has increased by over 329% YoY, with livestreamers for higher-end goods making more than $2000 a month, which is a comparatively high salary. Obviously, there are those who have seen the clear business opportunity. There are now vocational schools in China teaching livestreaming ecommerce as a field of study. For one Yunnan institute this past month, their students were snapped up by employers before they had even graduated. It’s good to know that at least some people are seeing their fates rising instead of sinking with this epidemic.

All for Livestreaming, Livestreaming for All

If you’ll remember, Luo Yonghao of Smartisan (failed smartphone maker) fame, whom we covered in Extra Buzz 005 as a prime example of the fan economy, is finally giving up on his hardware CEO dreams and resorting to livestreaming ecommerce for his fifth attempt and entrepreneurship. As for what yet, we know not, but it will be 20 carefully selected items from a sea of 1000. Because of his inherent celebrity, winning brands will need to pay a fee to be showcased, from the hundreds of thousands of dollars and up to seven digits. Set to debut on April 1st, rumors are flying that Bytedance’s Douyin signed him up for a $9mm contract, which he accepted in favor of even higher numbers from Kuaishou and Taobao. Others are saying this was a no-cash deal, with traffic being the primary driver. Douyin won out because it promised him 300mm viewer’s worth of traffic, which they could easily do by just featuring him on the frontpage, given that they exceeded 400mm DAU back in January. I don’t know the truth, but Luo does have 16mm fans, and a talent for making himself into a trending topic, which he’s monetized to his benefit before. Anyway, the reason why these rumors persist is because both Taobao and Kuaishou have indeed been way ahead of Bytedance in monetizing from ecommerce (see Tech Buzz Episode 55 for more), and so within its peer group, Douyin is likely to be more willing to shell out resources than anyone else to recruit such a well-known face in China tech. I am personally skeptical how a millennial-facing influencer is going to win on a Gen-Z favored platform, but Luo himself is famous for his oratory skills, and so may surprise me yet.

There is rapid diversification in the type of “livestreaming hosts” in China these days, again accelerated by the epidemic. Renowned “old brands” such as teashops, traditional Chinese medicine stores, and basically your grandmother’s favorite brands are all experimenting with livestreaming. And it’s not just the silver-haired who are livestreaming, but intellectuals too. Previously, the street peddler type energy and speech cadence of an Austin Li, top male Taobao livestreamer, has been snubbed by self-identified academic types as being too “low class.” However, at least one renowned intellectual, who also happens to be co-owner of an independent bookstore, has been experimenting with livestreaming, along with 200 other offline bookshops, which is a 5-fold increase for the sector. In a country where 64% of books were already being sold online, offline shops were already barely eking out an existence, but it seems that with smart topical programming – such as inviting a health expert – or authentic curation, people are still moving volumes (in the $000’s anyway). As optimistic as I am though, it’s still much too early to know if this will become a meaningful income stream. It may be that the entire sector will just go bankrupt and have to restart anyway. What it does tell us, however, is how every retail business will need to at the minimum, experiment with livestreaming ecommerce, and wait and see, if consumers respond.

What did you think of this issue? Let us know! And don’t forget to sign up for the webinar if you are a professional investor interested in luxury retail!